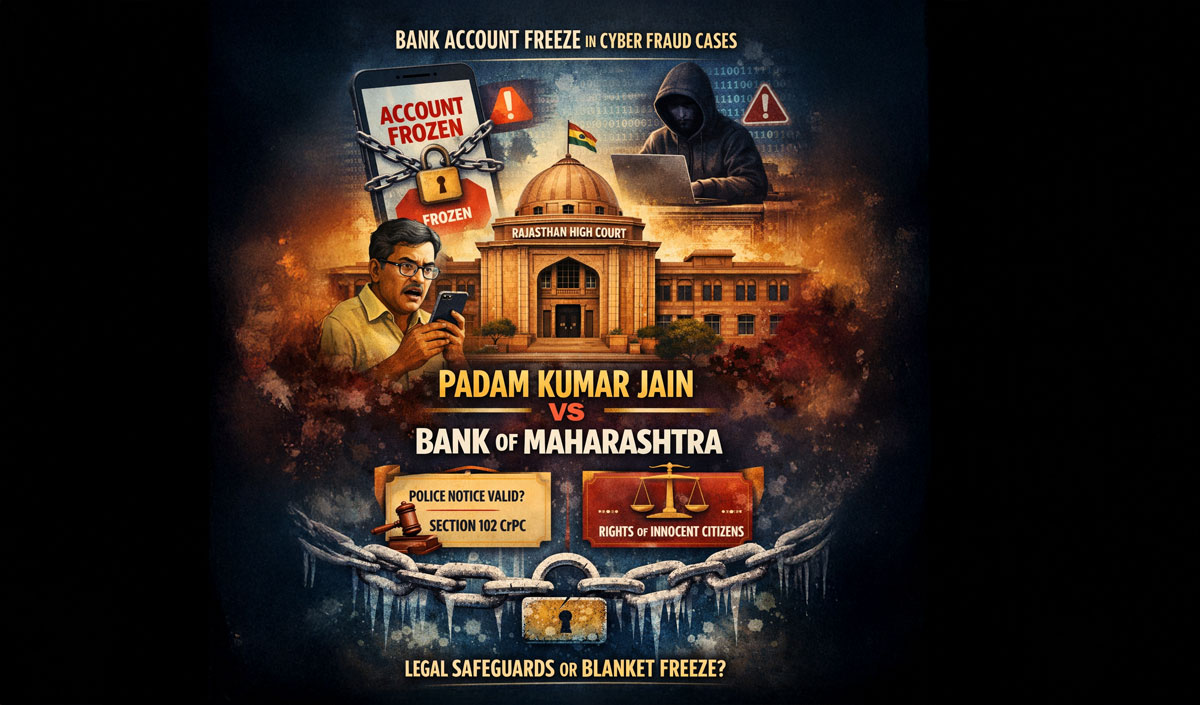

Bank account freezing has become a serious and growing problem in India, especially in cyber-fraud investigations. People across India are suddenly discovering that their bank accounts have been frozen due to a “suspicious” online transaction they know nothing about. A recent case before the Rajasthan High Court has brought this issue into sharp legal focus.

The Case at a Glance

In Padam Kumar Jain vs Bank of Maharashtra, the petitioner challenged the freezing of his bank account by Bank of Maharashtra. The account was frozen based on a police communication related to a cybercrime investigation, even though the petitioner claimed he had no involvement in the alleged fraud.

The core grievance was simple but powerful:

Can a bank freeze a person’s account merely on the basis of a police letter, without following proper legal procedure?

What happened in the Padam Kumar Jain case?

- Padam Kumar is a small kachori seller in Jaipur whose account with Bank of Maharashtra was frozen after Telangana cybercrime police flagged a few small transactions totalling about ₹5,000 as “suspicious”.

- The entire account was blocked, even though there was no direct evidence that he was involved in any cyber fraud, and it was used for his day‑to‑day business.

- As a result, his working capital dried up overnight, and his family’s livelihood was severely affected.

Padam Kumar approached the Rajasthan High Court through a writ petition challenging the freezing of his account.

What did the Rajasthan High Court say?

- A single‑judge Bench of Justice Anoop Kumar Dhand noted that courts are seeing a “flood of litigation” in which banks freeze accounts based solely on police letters, especially in cybercrime cases.

- The Court directed Bank of Maharashtra to de‑freeze Padam Kumar’s account, holding that freezing the entire account for such a small disputed amount without proof of involvement in fraud was not justified.

- At the same time, the Court said that the petitioner must co‑operate with the investigation, and the bank/police can deal with the disputed amount in accordance with the law.

Why is Section 102 CrPC important here?

- The Court highlighted that if a bank account is to be seized/frozen during an investigation, it must be done under Section 102 of the Criminal Procedure Code (CrPC), which deals with the seizure of property by the police.

- Under Section 102(3) CrPC, once property is seized, the police must “forthwith” report the seizure to the concerned Magistrate, a requirement that many investigating agencies ignore in bank‑freeze cases.

- The High Court openly posed a question to the legal community: Can a bank account be seized merely on a letter from the police, without following the procedure under Section 102 CrPC?

This question goes beyond a single kachori vendor and affects thousands of ordinary account holders whose accounts are blocked without notice or oversight.

Why does this judgment matter to you?

- Banks cannot mechanically freeze your entire account just because some police unit somewhere sends an informal request; there must be a proper legal basis and procedure.

- Due process and judicial oversight are essential: the freezing must be traceable to a lawful investigation and reported to a Magistrate, not done casually over emails and letters.

- The Rajasthan High Court’s approach shows that courts are willing to protect innocent account holders from blanket freezes, especially when the disputed amount is small, and there is no proof of their involvement in the alleged crime.

What you can do if your bank account is frozen

- Ask the bank in writing:

- Seek information on whether the freezing has been reported to the concerned Magistrate, as required under Section 102(3) CrPC.

- If you are not named as an accused and there is no evidence of your involvement, you can consult a lawyer and consider filing a writ petition in the High Court, relying on the reasoning in Padam Kumar Jain vs Bank of Maharashtra and similar rulings that disapprove arbitrary freezes.

The Padam Kumar Jain case is a reminder that investigation powers are not unlimited. Cybercrime control is necessary, but law-abiding citizens cannot be punished by default. Courts are now clearly signalling that procedural safeguards matter, even in digital-age crimes.

If more people become aware of their rights, arbitrary account freezes will not go unchallenged.

— — —

Disclaimer:

This article is published for general legal awareness and informational purposes only, and should not be construed as legal advice or a solicitation to act.

About the Author:

Joginder Poswal is an advocate enrolled with the Bar and practising law, specialising in cyber law, criminal law, and corporate compliance.

For more information, please refer to the contact details provided on this website.