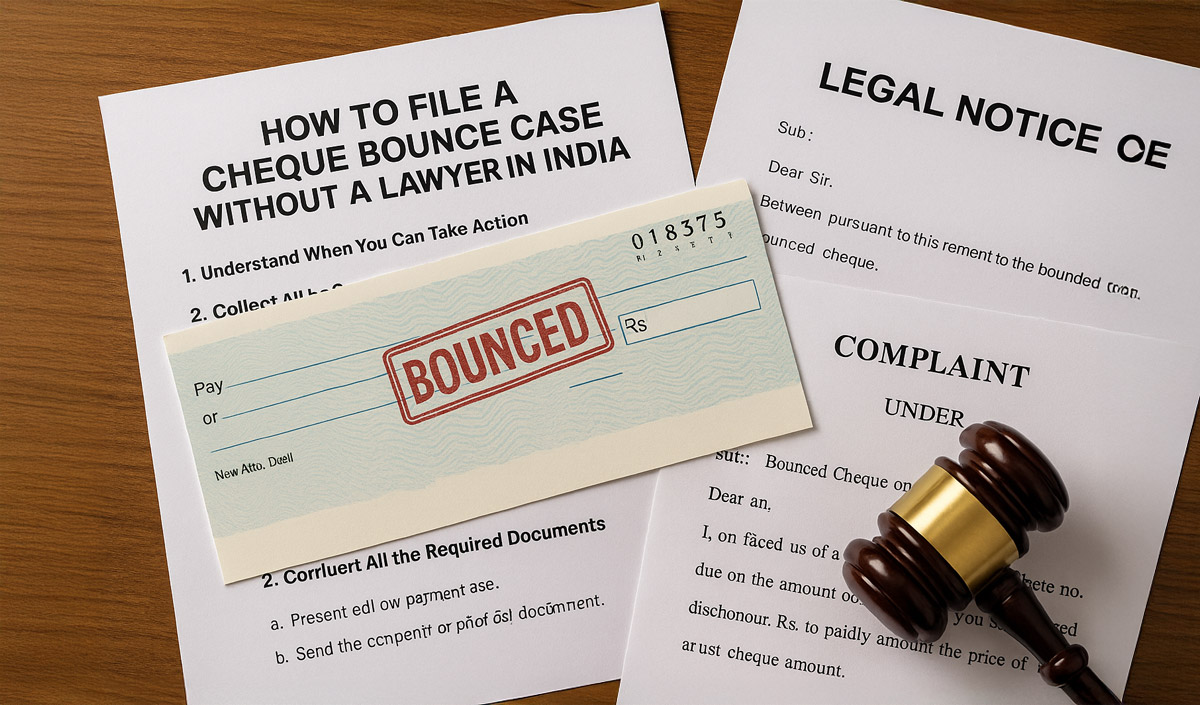

When a cheque bounces, it is not only about losing money; it can also become a legal matter.

In India, cheque bounce is a criminal offence under Section 138 of the Negotiable Instruments Act, 1881.

Most people think the only way forward is to hire a lawyer. Truth is, you can handle it yourself if you’re organised and know the process. Yes, it takes a bit of time, but you’ll save on legal fees and stay in full control of your case.

Here’s exactly how to go about it.

Step 1:- Check if Your Case is Valid

You can file a case only if these conditions are met:

- The cheque was given to you for payment of a real debt or loan, not as a gift.

- The cheque was deposited within 3 months of the date written on it.

- Your bank returned the cheque unpaid, with a Cheque Return Memo showing the reason.

- The reason for the bounce is insufficient funds, account closed, or similar valid grounds.

If these conditions are not met, the court will not accept your case.

Step 2:- Collect All Necessary Documents

Keep these ready before you start:

- The original bounced cheque.

- The bank’s return memo.

- Proof of the debt (invoice, written agreement, or even bank transfer records).

- Your ID proof.

- Postal receipt and copy of the legal notice (you will prepare this in the next step).

Always keep copies of all documents for your records.

Step 3:- Send a Legal Notice

The law requires you to send a legal notice before going to court.

Here’s how:

- Write a notice stating:

- Details of the cheque (number, date, amount).

- Reason for dishonour as given by the bank.

- A demand for payment within 15 days of receiving the notice.

- Send this notice by Registered Post (AD) or Speed Post.

- Keep the postal receipt and a copy of the notice.

If the person pays you within 15 days, the matter is closed. If not, you can move to court.

Step 4:- File the Complaint in Court

If there is no payment after 15 days:

- Go to the “Magistrate Court” or “Lower Court” where your bank is located.

- Prepare a complaint petition, a short written statement about your case.

- Attach all documents:

- Original cheque

- Bank memo

- Copy of legal notice

- Postal proof

- Proof of debt

- Pay the court fee (amount depends on your state, usually a few hundred rupees).

- File the complaint within 30 days after the 15-day notice period ends.

Step 5:- Attend Hearings

Once your case is filed:

- The court will send a summons to the person who issued the cheque.

- You must attend court dates and present your documents.

- Answer the judge’s questions clearly and truthfully.

Possible Results

If the court decides in your favour:

- The person may have to pay you up to twice the cheque amount.

- They could be sentenced to up to two years in jail, but most cases are resolved before that happens.

- You may get compensation.

Typical Timeline

- Day 1: Cheque bounces → Collect documents.

- Within 30 days: Send legal notice.

- Next 15 days: Wait for payment.

- Within the next 30 days: File a complaint in court.

Key Tips

- Always deposit cheques before their expiry date.

- Keep records of all payments and agreements.

- Do not delay sending the notice; the law has strict timelines.

- Even if you handle the case yourself, you can take help from a lawyer for drafting the notice or complaint.

Filing a cheque bounce case without a lawyer in India is possible if you stay organised and follow each step on time. Keep your documents ready, act quickly, and you can handle the process confidently.

— — —

Disclaimer:

This article is published for general legal awareness and informational purposes only, and should not be construed as legal advice or a solicitation to act.

About the Author:

Joginder Poswal is an advocate enrolled with the Bar and practicing law, specializing in cyber law, criminal law, and corporate compliance.

For more information, please refer to the contact details provided on this website.